Nigeria’s software development industry is experiencing rapid growth, driven by increasing digital adoption, government policies, and a thriving tech ecosystem. As businesses and startups seek innovative solutions, several trends are shaping the software landscape in 2025. Here are the top 10 software development trends transforming Nigeria:

1. Artificial Intelligence and Machine Learning Adoption

AI and ML are revolutionizing industries in Nigeria, from fintech to healthcare. Companies are leveraging AI for chatbots, predictive analytics, fraud detection, and personalized customer experiences. Expect to see more AI-driven applications optimizing business processes and decision-making.

2. Blockchain for Financial Inclusion and Security

Blockchain technology is gaining traction in Nigeria, particularly in finance, supply chain management, and identity verification. With a rising demand for secure digital transactions, blockchain is enabling transparent, tamper-proof financial services and smart contracts.

3. Rise of Low-Code and No-Code Platforms

Businesses are increasingly adopting low-code and no-code platforms to speed up application development. These platforms allow entrepreneurs and enterprises to build software solutions with minimal coding knowledge, reducing costs and development time.

4. Cloud Computing and SaaS Growth

The shift to cloud-based solutions continues to expand in Nigeria, driven by scalability, cost-efficiency, and accessibility. More businesses are adopting Software-as-a-Service (SaaS) models to streamline operations and reduce infrastructure costs.

5. Cybersecurity and Data Protection Advancements

With cyber threats on the rise, Nigerian businesses are prioritizing cybersecurity. Organizations are investing in advanced security measures, including encryption, multi-factor authentication, and AI-powered security solutions to protect sensitive data and digital assets.

6. Mobile App Development for Fintech and E-Commerce

Nigeria’s fintech and e-commerce sectors are booming, fueling the demand for mobile applications. With more consumers relying on mobile banking, digital payments, and online shopping, developers are focusing on creating seamless, user-friendly, and secure mobile apps.

7. Internet of Things (IoT) in Smart Cities and Agriculture

IoT applications are expanding in Nigeria, particularly in smart city development, energy management, and precision agriculture. IoT-enabled solutions are enhancing urban planning, optimizing resource management, and improving agricultural productivity.

8. 5G and Edge Computing Adoption

With the rollout of 5G networks in Nigeria, software development is shifting towards edge computing. Faster internet speeds and reduced latency are enabling real-time data processing, which is critical for IoT applications, AI models, and immersive experiences.

9. Progressive Web Applications (PWAs) for Enhanced User Experience

PWAs are gaining popularity as businesses seek lightweight, fast-loading, and responsive web applications. These apps provide an app-like experience while being accessible through web browsers, making them ideal for Nigeria’s mobile-first audience.

10. Regulatory Compliance and Digital Transformation Policies

Government policies and regulations are playing a crucial role in shaping Nigeria’s software development landscape. Developers are focusing on compliance with data protection laws, fintech regulations, and industry-specific digital policies to ensure smooth operations.

Conclusion

As Nigeria continues to embrace digital transformation, these software development trends will play a pivotal role in shaping the country’s tech ecosystem. Businesses, startups, and developers must stay ahead of these trends to remain competitive and drive innovation in the Nigerian market.

Looking for a reliable software development company in Nigeria? At Optisoft, we specialize in cutting-edge software solutions tailored to your business needs. Contact us today to build scalable, secure, and innovative applications.

In today’s fast-paced financial landscape, Microfinance Banks (MFBs) face increasing pressure to streamline operations, reduce costs, and enhance efficiency. Manual financial processes, often prone to errors and delays, can hinder growth and impact profitability. This blog post explores the critical need for automation in MFB financial management and how Ezone FINMAN offers a comprehensive solution to optimize processes and boost efficiency.

The Challenges of Manual Financial Processes for MFBs:

Traditional, manual financial processes present several challenges for MFBs:

- Time-Consuming: Manual data entry, reconciliation, and reporting are incredibly time-consuming, diverting valuable resources from core business activities.

- Error-Prone: Human error is inevitable, leading to inaccuracies in financial records, reporting, and compliance, potentially resulting in financial losses and regulatory penalties.

- Costly: Manual processes require significant manpower, increasing operational costs and impacting the bottom line.

- Lack of Real-Time Visibility: Manual systems often lack real-time insights into financial performance, making it difficult to make informed decisions.

- Scalability Issues: As MFBs grow, manual processes become increasingly difficult to manage, hindering scalability and expansion.

The Benefits of Automating Financial Processes:

Automating financial processes offers numerous benefits for MFBs:

- Increased Efficiency: Automation streamlines workflows, reduces manual effort, and accelerates financial operations, freeing up staff to focus on strategic initiatives.

- Improved Accuracy: Automated systems minimize human error, ensuring accurate financial data and reporting, reducing the risk of financial losses.

- Reduced Costs: Automation lowers operational costs by reducing manpower requirements and minimizing errors.

- Real-Time Insights: Automated systems provide real-time visibility into financial performance, enabling data-driven decision-making.

- Enhanced Compliance: Automation helps MFBs adhere to regulatory requirements by ensuring accurate and timely reporting.

- Improved Scalability: Automated systems can easily handle increased transaction volumes and data as the MFB grows.

- Better Customer Service: Faster and more accurate financial processes lead to improved customer service and satisfaction.

How Ezone FINMAN Automates Financial Processes for MFBs:

Ezone FINMAN is a purpose-built financial management solution designed to address the specific needs of MFBs. It offers a range of automation features that enhance efficiency and optimize financial operations:

- Automated Account Creation (NUBAN Compliant): FINMAN automates the creation of NUBAN-compliant accounts, eliminating manual data entry and reducing processing time. This ensures compliance and speeds up customer onboarding.

- Streamlined Transaction Processing: FINMAN automates transaction processing, from initiation to settlement, reducing manual intervention and minimizing the risk of errors.

- Automated Reconciliation: FINMAN automates the reconciliation of financial transactions, ensuring accuracy and saving valuable time.

- Automated Reporting: FINMAN generates automated financial reports, including regulatory reports, saving time and ensuring compliance.

- Automated Risk Control: FINMAN automates risk control processes, such as setting transaction limits and flagging suspicious activity, preventing fraud and minimizing financial risks.

- Seamless Customer Management: FINMAN automates customer data management, providing a centralized view of customer financial information and improving customer service.

Key Features of Ezone FINMAN for Enhanced Efficiency:

- User-Friendly Interface: FINMAN’s intuitive interface makes it easy for staff to learn and use the system, minimizing training time and maximizing productivity.

- Cloud-Based Solution: As a cloud-based solution, FINMAN offers accessibility from anywhere with an internet connection, improving flexibility and collaboration.

- Integration Capabilities: FINMAN can be integrated with existing MFB systems, ensuring seamless data flow and avoiding data silos.

- Robust Security: FINMAN employs robust security measures to protect sensitive financial data and ensure compliance with industry regulations.

Conclusion:

Automating financial processes is no longer a luxury but a necessity for MFBs looking to thrive in today’s competitive environment. Ezone FINMAN provides a comprehensive solution to automate key financial operations, enhance efficiency, reduce costs, and improve compliance. By embracing automation, MFBs can free up valuable resources, focus on strategic growth initiatives, and deliver better service to their customers.

In the last post, we saw how to scale your business.

You can read that here.In today’s article, we will be discussing how to grow your business using tech.

That is, how to bring in new customers and increase revenue in your business using tech as a means for that.

Your business is all about customers. You need people to buy whatever it is that you sell. Be it a product or a service. Every product is designed for a customer, the same for every service. We design products because people need them. And those who need the product or service that we offer are called customers. The essence of customers is to bring in money by buying what it is we sell. The money that they bring in is what is called revenue.

Businesses bring customers; customers generate revenue.

If a business must grow, it must be able to attract customers, retain the customers it has brought in, and had these customers pay for the service or product being offered without thinking twice. These customers’ ability to keep paying is what determines revenue and how much money generated determines how you operate your business.

To keep being in business, you must learn how to grow your business. But have it in mind that growth isn’t profit. To be profitable, you have to scale. Learning to scale is easy if you read this article.

How to Grow your Business Using Tech

In today’s world, tech has moved from just a tool to becoming an integral part of us. If we must move with the times and even ahead of the trend, tech is vital. Even if your business has nothing to do with tech, integrating tech into your business operation will tremendously and increase your efficiency. For businesses to grow today, tech is needed. From your marketing to your inventory management, tech has simplified and has given you access to systems and tools that enable business growth at a sporadic rate if used and optimized.

Here are a few ways any and every business can use to attract customers and increase revenue.

Social Media

According to statista.com, 3.6 billion people were using social media in 2020. And a projection of 4.41 billion users is expected by 2025.Social media is the key to nurturing relationships with your customers and showing them personal insights into your business that makes your customers feel closer to you. When a customer can relate to what you post online, they connect with your brand, making it easier for them to move from prospects to become customers. No business does not have a market online!

If you want to acquire new customers, social media should be your first way to go about it. You should be able to market your business across social media platforms.

Digital marketing has become a necessity in modern-day business. From SEO, Facebook ads, google ads, and Instagram ads, your business has many customers waiting if you can effectively market it.

Swift Operation

When you introduce social media into your business, it means you want to be more productive, become more efficient, and even reduce your operation cost. From your customer acquisition process to the sales process and your inventory management, introducing technology reduces bottlenecks. Customers love smooth service. Which, if you can offer such, retains them and gives you an endless cycle of revenue.

- Payment

Payment is a significant part of every business. Businesses exist because people pay for a service or a product. Making this payment process easy for the customer has a high chance of retaining a customer for the business.

In 2019, digital and online wallets accounted for 41.8 percent of online transaction volume worldwide. This shows that many global businesses are switching things up by making payments easy and swift for customers. If you want to grow your business, making payments easy for the customer is a pragmatic solution.

- Card System

Customers love to use money-saving technology, be it a gift card system or an app that gives out coupons and deals. Introducing an exclusive card membership system makes them feel appreciated and invested in your company, which makes them return and helps you retain them.

- Websites and Mobile Apps

Not every business should have a mobile app, but every business should have a website. A website is the only thing that guarantees that you are seen, and you are heard. The world lives on the internet, and positioning yourself for them helps you get more customers.

Your website is your new billboard. It should contain what the business is all about, business address, and detailed information about your product and services. People tend to buy from businesses that are visible to them. Before people make purchases, they first enquire about the business to know how genuine the company is. When your business can be easily seen online, then you stand a high chance of having the prospect of becoming a customer.

Implementing these technologies will increase your sales and help increase revenue. Try them out today and share your experience.

A lot of small business owners are concerned with growth. All they want is an increased workload to show that they are working, increased revenue, and maybe a good LinkedIn recognition. In the quest to achieve the above, they end up burning energy and being less productive, and having a high operating cost with most times: little profit.

Growth is good if you want to show the world how much of a hardworking fellow you are. But if you’re going to do less work and see a big profit, then your answer is in Scaling. Scaling doesn’t make you lazy. No! Instead you become more productive if you scale. Imagine working very hard to increase revenue only to end up with high revenue and a very high cost. When you scale, more money is added to your bank account while you are less involved in the business activities’ daily running.

Scaling is about initiating systems and procedures that increase productivity. When you scale, you leverage people’s time, money, and relationship for your business’s smooth running and your less involvement in the day to day running of your business. Scaling ensures that your growth strategies are sustainable while adding new customers and growing your revenue without adding extra work to your plate. It is in the best interest of small businesses to choose scale over growth. It’s the business owner choosing smart work over hard work.

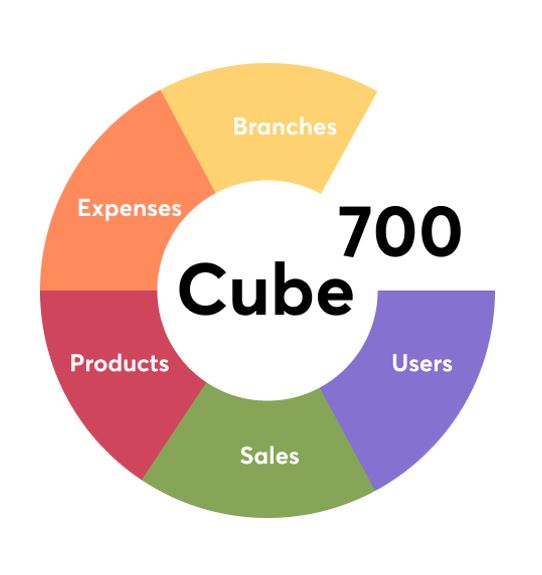

An inventory management system accurately tracks and controls your inventory. Inventory management software such as Cube 700 makes it easy to add products or sales channels. The software allows you to compare sales data right across your business.

How can small businesses scale using Tech?

And in today’s series of Using Tech, focus shall be on: USING INVENTORY MANAGEMENT SYSTEM TO SCALE YOUR BUSINESS.

In business – specifically retail, a proper understanding of your inventory can make or break your business. Every entrepreneur should be able to manage their inventory as it is vital. Spreadsheets can not do the work today, as it does not: scale with your business. Instead, it adds multiple sheets, which leaves you with more work, and most times, you are left with error-filled sheets. If you must scale your business, you must put in place processes and procedures that allow you to scale. And one of such is an inventory management system.

When using an inventory management software like Cube 700, it allows data flow automatically from one system to another because of the cloud storage. Unlike the manual inventory system where data is entered manually into several systems, inventory management software sends information across your systems. You don’t have to enter them. They are moved from one point to another. So, when a product is purchased, your online shop tells your accounting software. Which records your tax and revenue, you also have displayed on your dashboard your store profitability live on your mobile, and the software can automatically reorder if you are getting low on stocks. This system is up to date and gives you freedom from manual entry errors while giving you the tools to improve your business. Another thing an inventory management system is going to do for you is: give you up-to-date data for important decisions. Information such as: which product sells the most? Who is most likely to purchase them? When should you order more, and how much should you keep in stock?

An inventory management software gets this data, shows you the detail, finds your star product, and creates reorders for you while it compares running cost. And because it is cloud-based, your data can be accessed at any place at any time. Having a cloud-based inventory management system like Cube 700 gives you mobile access to your inventory to expand your business. You can check your stock levels, receive notifications, and reorder products on the go.

There is a lot to gain in scaling your business. And scaling rightly with the right software (Cube 700) is the best decision that you can take this year for you and your business.

Business itself responds to human problems by offering solutions in exchange for value, mostly money. But although businesses solve problems, they are not spared by problems. What makes a business successful is its ability to solve human problems and as well solve the problems that arise within itself as it finds a solution to human challenges. In time past, due to scanty innovations and the non-existence of tech, many businesses didn’t have to think a lot to get the problem solved within themselves. Their lack of means meant they had to work with what they had without trying to innovate.

Technology changed that. Today, the world is moving at a swift pace, and businesses are all trying to catch up with it, therefore, facing the challenge of aligning their processes to be able to solve the problems they have set out to set. Today, businesses are faced with the challenge of using tech to solve customer problems and as well using tech to streamline internal operations to be able to keep up with customer demands without collapsing the system.

Today’s post shall explain how businesses can leverage tech to solve the problem of operations with specific emphasis on commerce.

Using Technology to Solve Commerce Problems

Never has there been a time when buying and selling needed tech than this. Not just starting an e-commerce platform, but also running the day to day activities of commerce businesses, tech is in high demand than ever. From sourcing for products, lead generation, marketing campaigns, finding the right market place to sell products, to building optimal sales funnels, commerce has a high need for tech.

Data Problem

Business owners used to have that book with documented customer details (much business still do). This was very inefficient. Many times, they had so many books containing customer details that it was difficult and sometimes impossible to get customer data.

Then came spreadsheets. The invention of Microsoft excel made it easier for data to be documented. Businesses no longer had to use books to record customer data. And as things improved, there was the invention of the sales automation system. They made it so much easier to document data and carry out campaigns seamlessly with the data that businesses have.

Marketing Problem

The internet changed the way businesses reached out to customers. Marketing was traditional and very inefficient in reaching out directly to the target market. You could not niche down traditional marketing. Your radio jingle, TV advert, and billboard had to speak to everyone. This was challenging for businesses.

But today, businesses can run ads on online platforms and even target this ad to their market. And it’s cheaper. Tech has solved the problem of reaching out to your target market. From SEO, Facebook ads, and email marketing, tech has made marketing easier and cheaper for businesses.

Payment Problems

During my last shopping, payment was made with my debit card. We have moved from an era of cash payments to an age where payments can be made through bank transfers. The issue of cashier accountability is gradually fading out for businesses. All they need to do is integrate seamless payment processes into their business and see every penny accounted for.

The beginning of seamless payment is just upon us. With time, payments will be more simplified more, giving both businesses and their customers better ways to make and receive payments.

Product Delivery

Customers now track their products. People purchase products continents away and can still keep track of those products until it gets to them. Trust has been built amongst customers because they track their wares and have it delivered to them.

This is one aspect of commerce that technology has been able to solve, giving businesses the leverage to build trust amongst clients, therefore having them do business beyond their national borders: increasing product reach and market share.

If traders can leverage tech in their sales process, there is a lot to gain. Ecommerce is not here to go but to stay. It will be in the best interest of traders to use tech in their sales and operation process to increase their reach and market share.

What are those aspects of commerce that tech can solve?